SoFi (SoFi - Summary): The Future of FinTech

SPACs might be dead (sorry Chamath), but this one merger has a cult-like following as the buzz around the name continues to grow. This SPAC is IPOE and the merger is with FinTech company SoFi. Brick and mortar banks and queuing in line for services is so 2019, in 2021 this process has become digitized and the goal is to have a bank in your pocket.

Banks vs FinTech

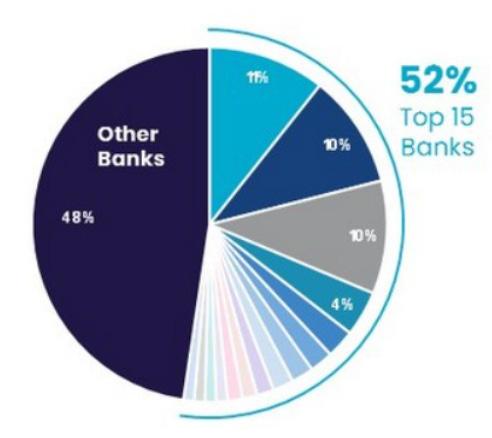

The expansion of financial services and cross-selling of them to existing customers has been a common strategy for traditional banks and finch companies alike. Traditional banks have a massive, already established customer base that they can easily cross sell other financial services to. In fact, the top 15 banks in the world control over 50% of all US bank accounts.

SoFi’s moat surrounds 3 different segments:

Lending: Personal/student loans and refinancing

Tech Platform: Galileo acquisition and payments infrastructure

Financial Services: Investing, credit cards, money transfers, etc

Galileo

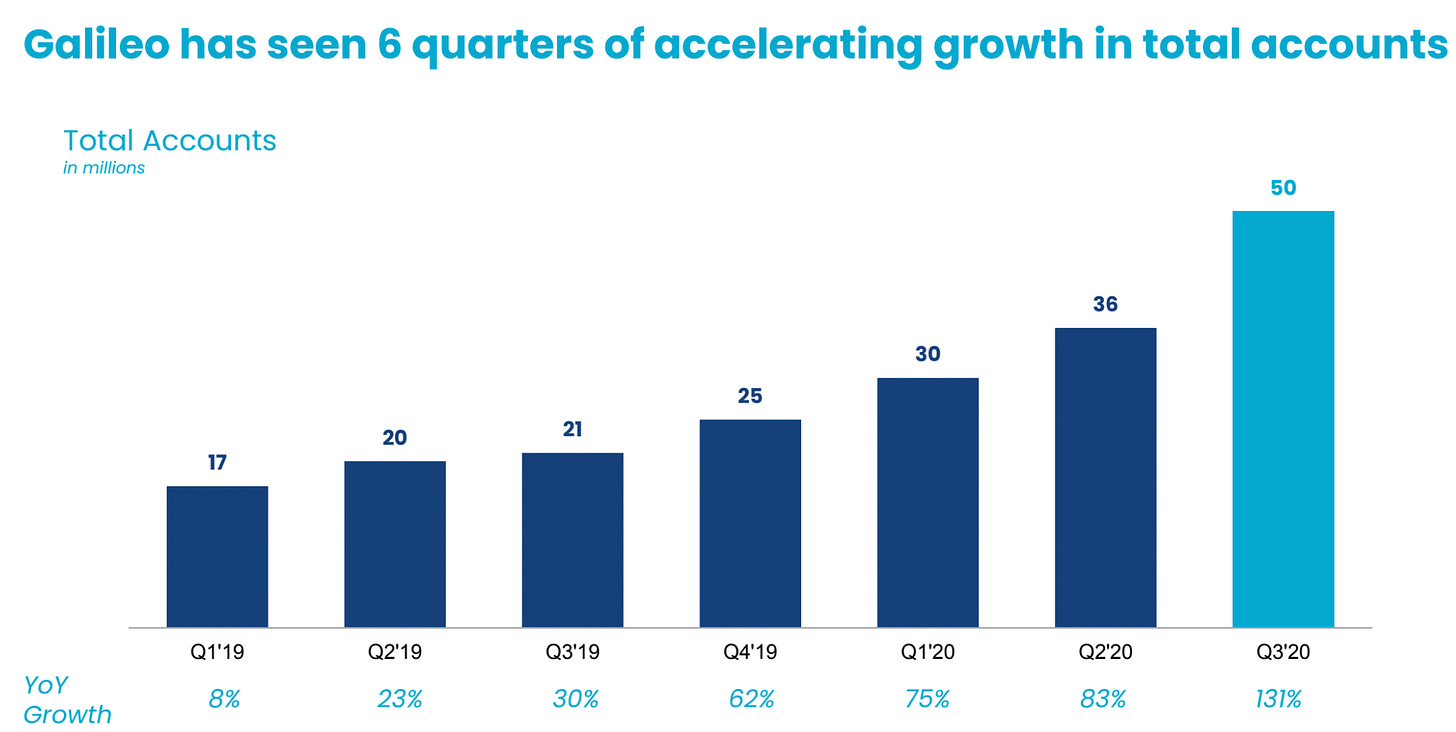

I want to touch up on Galileo because SoFi’s acquisition of the company was highly strategic and has enabled them to integrate at a larger scale. Galileo is a B2B purchasing/payment platform that works with FinTech entities such as Robinhood, Chime, Monzo, and Revolut. With the Galileo platform, these companies can create complex financial payment processes and enable digital banking solutions. Think of Galileo as the infrastructure behind it all and they are growing by over 100% YoY.

Trends & Growth

So why don’t the banks just use their existing customer base to expand into the FinTech industry? Short answer: Because they are BOOMERS. The truth is their legacy infrastructure and IT costs do not help when transitioning into the FinTech space. As per Morgan Stanley, most FinTech startups can actually offer these services at nearly 50% cheaper than the traditional banks.

There are some tailwinds the industry is riding that ranges from more and more customers accessing banking services digitally (this number is even higher among millennials), rise in digital payments by over 20% from 2019 into 2020, and FinTech becoming increasingly popular among personal loans.

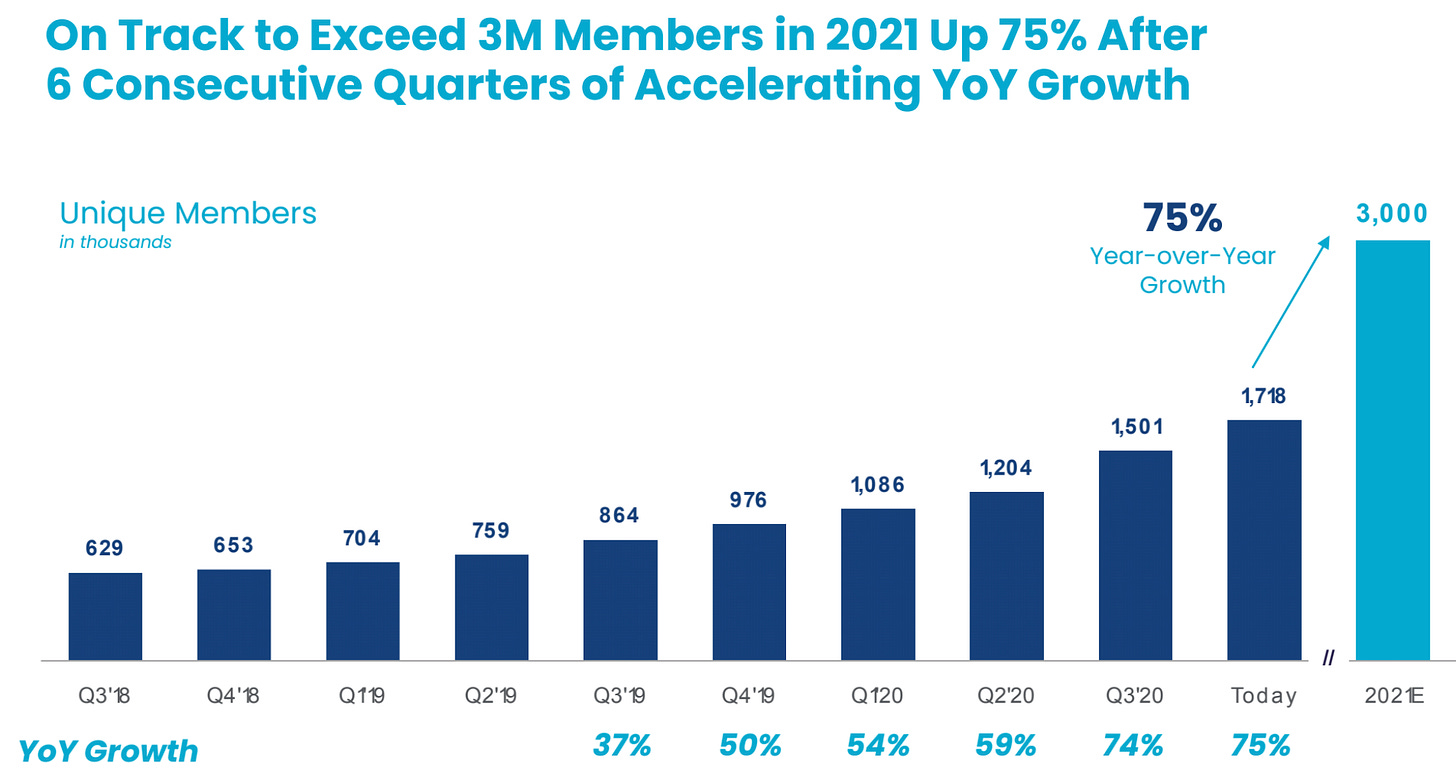

SoFi’s customer base has been growing at an average of 66% YoY with their last two quarters hitting 75% growth each. It is no doubt that the platform, the industry, and everything about the business is becoming increasingly popular. Management has noted by year-end 2021 they are expecting to hit over 3 million members (currently at 1.7 million).

Conclusion

What was mentioned above paints a picture that FinTech is disrupting traditional firms across all avenues of financial services (loans, investments, and banking). Traditional banks are failing to keep ahold of the new generation of customers coming into the market. SoFi is able to circumvent the inefficiencies in our current financial systems and provide unparalleled customer service for all their services.