Lilium (LILM - Full Stock Analysis): Taxis of the future

This is a “Full Company Research” that was made public (free). Enjoy! If you like what you see in this report and want to begin receiving similar company research each week directly to your inbox please subscribe below!

LILM at a glance

LILM is a German-based electric vertical takeoff and landing (eVTOL) company specialized in the design and production of Lilium Jets. Currently, their core product is the 7-seat Lilium Jet. The jet offers a few core capabilities (source):

Carries 6 passengers and 1 pilot

Is low-noise (so it can be positioned within communities without disrupting them)

Sustains a cruise speed of 175 mph

Has a range of ~155 miles

Can be charged fully in 30 minutes

The idea is that they can create a new kind of air travel more akin to a taxi service than our current air travel model. They wish to compete with short-haul air travel. Short-haul is a term that describes any flight that takes between 30 minutes to 3 hours. It is usually shorter distance (within LILM’s 155 mile range) and comprises of 85% of all commercial flights (source).

They plan on a commercial launch in 2024 which means having production-ready jets available and building out their custom LILM landing pads within key cities and locations. They are both EASA (European aircraft operations) and FAA (American aircraft operations) certified.

LILM is also a sustainability play, albeit an overblown one. While electric aerospace vehicles are remarkably better for the environment than their counterparts, around 80% of C02 emissions from flights are emitted from long-haul flights (source) which LILM does not plan on competing against. LILM will not drastically alter the aerospace sustainability metrics, but they will certainly try to disrupt short-haul travel and longer vehicular road trips.

The eVTOL industry

The eVTOL industry is not even a buddying industry, but a bleeding edge one. Currently, there is no mass-adoption of commercial eVTOL services. Therefore, while most estimates are based upon speculation, the eVTOL estimates are even more so. I say this only as a word of caution using these numbers as a hard estimate rather than a directionally correct figure.

Globally, the eVTOL industry is projected to reach $31B by 2030 (source). This growth is attributed to a growing need for greener transportation as well as the inconvenience of modern air travel. Furthermore, electric vehicle technology such as batteries have advanced to a point where eVTOL services can be offered both cheaply enough to be commercially attractive while maintaining profits. This projected estimate is based not just on commercial travel, but also commercial delivery services, competing against the last-mile delivery industry.

Other, more bullish estimates, see eVTOL to be an eventual $1.5T market by 2040 (source). This is an estimate by Morgan Stanley who has this market eventually topping out at $9T by 2050 based upon the value of commercial transportation and urban parcel delivery.

The financials

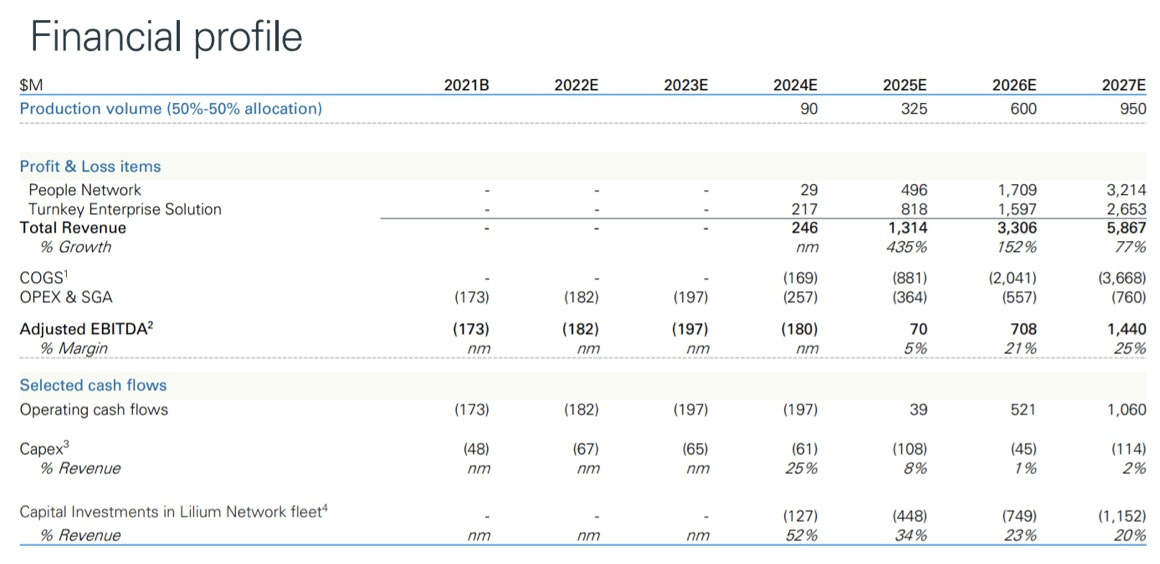

There is currently little to no information about the financials for LILM. Even the financial information they offer within their investor presentation is made up nearly entirely of self-made projections. While most early companies lean into self-made projections, this is the first time I’ve ever seen a company lean as hard as LILM.

However, a few things can be gleamed from what we know about the company. LILM went public on the NASDAQ through a SPAC. Because of this deal, they were able to raise ~$830M for their operations (source). Previously, their last round of funding raised ~$400M which means that they have a war chest of just over $1B to fund their operations.

Where LILM stands

The bull case

LILM presents an alternative way for travel and short-distance cargo haul than what is currently available in the market. Their goal is to reduce the costs of air travel to be less than $1 per passenger mile which would severely undercut their competition for air travel (but not for simple driving). However, competitor estimates mostly agree on the ~$6 per passenger mile cost which would make eVTOL transportation prohibitively expensive (source). If they are able to achieve the $1 cost goal, they will not just disrupt short-haul air travel, but obliterate the industry in its current form. Their current deals are:

A $1B deal with Brazilian airline Azul for an aircraft and infrastructure package to begin operations in 2025 (source).

A partnership with Ferrovial, a $10B asset manager for airports, to build out eVTOL infrastructure in Florida (source).

A partnership with Dusseldorf and Cologne/Bonne airports to use their airports as eVTOL hubs by 2025 (source).

Furthermore, LILM’s projected metrics for their jet are superior to their competitors (source):

The only caveat here is that US-based Joby (possibly their number 1 competitor) is not mentioned within this graph, but has metrics very similar to LILM’s jet. With both certifications from the FAA and EASA, LILM is on track for completely disrupting the airline industry.

The bear case

The risk here is that their war chest of $1B may not be enough. They claim to have a team of over 600 full-time aerospace engineers while funding aggressive expansion projects to build out the infrastructure needed to support their aerospace vehicles. For example, their planned infrastructure build out for Florida alone costs ~$200M (source). None of their current deals with larger players are binding and it could all fall through before any operational dates. While they do have certification, they still need safety certification and plan to achieve this by 2023, which is a extremely ambitious timeline for any aircraft never mind an eVTOL one (source).

Furthermore, the eVTOL industry is so young that its impossible to have any real projections. Is the flying taxi idea truly a competitive business model or will it just be some shiny toy for the upper class? While there is real tangible value in last-mile delivery of packages, this is definitely a crowded space with many massive players considering a ton of different technologies.

Lastly, the most damning point for LILM is their lack of transparency. SPACs are famous for being scams, hiding rotten companies behind pretty charts and graphs. While LILM does have a product out, they are painfully untransparent about their financials. A Piper Sandler analyst bullish on LILM still believes that the company will almost certainly need additional funding which means further dilution in their stock price (source).

The verdict

LILM may not be the best short-term play, but might be decent if you wish to invest in the eVTOL industry long-term (think 10-year horizon). The reasons for this two-fold opinion are that LILM is being uncharacteristically untransparent with both their timelines as well as their financials. No doubt, they are exaggerating a lot of their metrics in order to raise funding (a common strategy in SPACs). They are also giving very ambitious timelines which, from a regulator perspective, is simply detached from reality.

However, I also believe that they are a legitimate player in the eVTOL industry. The technology appears to be real enough and if they can survive their financial woes, which I see is likely given the size of their investors – Tencent for example (source), then they can materialize the deals they already have in place. This would solidify them as a legitimate company and player within the eVTOL industry.

Positions Disclosure: The author of this article does not have a position in the stock.

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.