Intel Corp (INTC - Full Stock Analysis): Too little too late

Welcome to one of the only newsletters dedicated to stock research articles digging into the business models of many popular companies among retail traders. A quick note, we will be transitioning the newsletter into a monthly release with editions being sent out on the first Sunday of every month, less holiday weekends where they’ll be sent out the following week. Enjoy.

INTC at a glance

INTC is an American corporation headquartered in California. They are the world’s largest semiconductor chip manufacturer and maintain a presence in multiple technology business segments including (source) (source) (source):

Client Computing: the largest of INTC’s business segment, client computing includes the production and sale of computer processing chips used in notebooks, tablets, phones, and other technology products.

Datacenter and AI: this business segment deals with the production and sale of enterprise-grade computer processors and chipsets designed for cloud and communications infrastructure. AI is used primarily to create efficiencies within datacenters here.

Networking and Edge Computing: this business segment provides a portfolio of hardware and software platforms designed to allow customers access to IoT enablement. This is also packaged with INTC’s networking products such as ethernet and silicon photonics.

Accelerated Computing and Graphics: this business segment focuses on discrete GPU devices (GPU devices separate from the CPU) and seeks to compete with established players like AMD and Nvidia.

Foundry Services: this business segment seeks to provide specialized technology manufacturing as a service to other business customers. It takes advantage of INTC’s specialized expertise in chipset manufacturing and offers that specialization to other businesses.

Mobileye: this business segment focuses on self-driving AI.

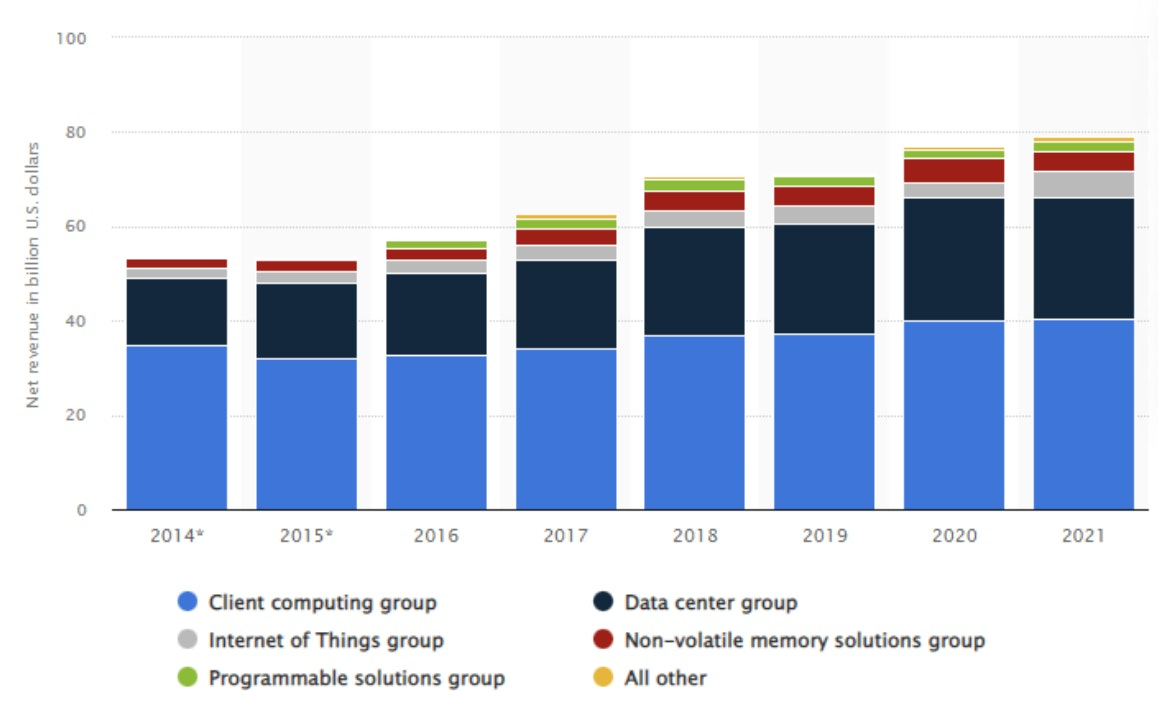

INTC’s core business segments are in client computing and datacenter products. Together, they account for over 85% of INTC’s total revenues and have done so consistently over the past five years (source).